Introduction

In an industry as fast-paced and competitive as finance, marketing strategies must keep up with shifting consumer behaviors, increasing digital touchpoints, and growing regulatory demands. Financial services marketing automation has emerged as a game-changing solution, enabling institutions to reach the right audience at the right time with personalized messaging while streamlining operations and maximizing return on investment. By integrating advanced automation tools with data-driven insights, financial firms can transform how they interact with clients, nurture leads, and build trust in a highly regulated environment.

The Evolution Of Marketing In The Financial Sector

Marketing in the financial sector was once a manual and rigid process, focused largely on traditional channels like print ads, cold calls, and physical mailers. While effective in their time, these methods lacked personalization, scalability, and measurable ROI. The advent of digital marketing opened the door to new strategies such as email marketing, social media campaigns, and search engine optimization. However, managing these channels manually soon became overwhelming as consumer expectations evolved. Marketing automation offered a way to bridge this gap by automating repetitive tasks, allowing marketers to focus on strategic initiatives while ensuring timely and relevant communication with customers. This shift marked the beginning of a digital revolution in how financial services approach marketing and customer engagement.

Why Marketing Automation Matters In Financial Services?

Financial services operate in a unique landscape where trust, compliance, and long-term relationships are paramount. Marketing automation provides a structured framework for financial institutions to deliver consistent and compliant messaging while adapting to individual customer needs. Automation tools can segment audiences, track behaviors, and trigger communications based on predefined rules. For example, a customer who visits a bank’s mortgage page multiple times can automatically receive targeted emails with home loan information, application tips, and personalized offers. This type of contextual marketing enhances the customer experience, increases conversion rates, and builds loyalty without overburdening marketing teams. Furthermore, automation ensures regulatory compliance by enforcing standard messaging templates and tracking customer interactions for auditing purposes.

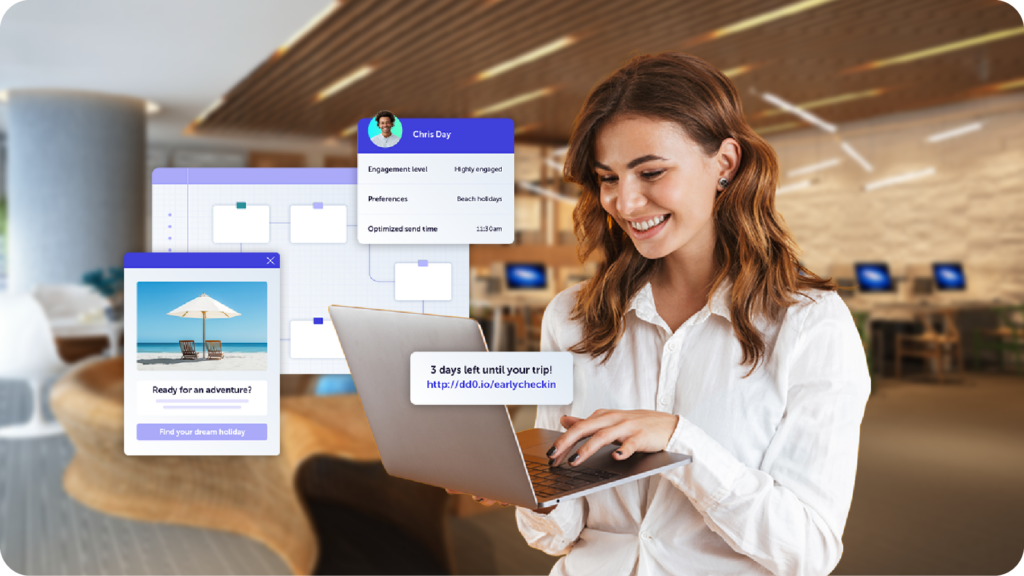

Personalization At Scale With Automation

Personalization is no longer optional—it’s a necessity. Customers expect financial institutions to understand their unique needs, preferences, and financial goals. Marketing automation enables personalization at scale, using behavioral data, demographic information, and financial history to create highly targeted campaigns. From customized email content to dynamic landing pages and personalized financial recommendations, automation allows marketers to tailor the entire customer journey. For instance, a wealth management firm can use automation to send investment advice tailored to a client’s risk profile, financial goals, and recent portfolio activity. This level of personalization fosters trust and positions the brand as a knowledgeable, client-centric partner.

Lead Nurturing And Customer Journey Mapping

The financial decision-making process can be lengthy and complex, involving multiple stages from awareness and consideration to decision and retention. Marketing automation is invaluable for nurturing leads through each stage of the customer journey. Automated workflows can deliver timely content that educates prospects, answers common questions, and gently nudges them toward a decision. For example, a credit union offering small business loans might design a multi-step email campaign that begins with educational content on business planning, followed by loan eligibility criteria, case studies, and finally, a call to action to apply. By mapping the customer journey and aligning content with each phase, financial institutions can guide prospects smoothly through the funnel and improve conversion rates.

Omnichannel Consistency And Integration

Modern consumers interact with financial brands across multiple channels—email, websites, mobile apps, social media, and even chatbots. Delivering a consistent message across all these touchpoints is crucial for maintaining trust and brand integrity. Marketing automation platforms can unify communications across channels, ensuring that a customer receives coherent messaging regardless of where they engage. For instance, if a customer clicks on a social media ad for a retirement plan, automation tools can track that behavior, trigger a follow-up email with more information, and even display relevant ads the next time they visit the website. This level of integration creates a seamless and engaging experience that keeps the customer connected to the brand.

Data-Driven Decision Making And Analytics

One of the most powerful aspects of marketing automation is its ability to generate actionable insights through data analytics. Every automated campaign produces data on customer behavior, engagement rates, conversion paths, and ROI. Financial marketers can analyze this data to identify what’s working and what needs improvement. Advanced automation platforms offer dashboards, real-time reporting, and A/B testing features that help refine marketing strategies over time. For example, if an email campaign promoting a new savings account has a low open rate, marketers can test different subject lines or send times to improve performance. By continually optimizing campaigns based on data, financial institutions can maximize the impact of their marketing efforts and drive sustainable growth.

Enhancing Compliance And Risk Management

Financial marketing is subject to strict regulations from bodies like the SEC, FINRA, and other regional regulatory authorities. Failure to comply can result in significant fines and reputational damage. Marketing automation helps mitigate compliance risks by standardizing communications and maintaining detailed records of all customer interactions. Automated approval workflows can ensure that every piece of content is reviewed by legal and compliance teams before it goes live. Moreover, automation tools can flag non-compliant language or unauthorized changes, providing an extra layer of protection. This ensures that marketing teams remain agile without compromising regulatory standards, allowing for innovation within a compliant framework.

Boosting Operational Efficiency And Reducing Costs

Marketing automation significantly reduces the manual workload associated with repetitive tasks such as sending emails, scheduling social media posts, segmenting contact lists, and tracking campaign performance. By automating these functions, financial institutions can free up valuable resources, allowing teams to focus on strategy, creativity, and customer experience. Additionally, automation helps reduce marketing spend by improving targeting and eliminating wasted efforts on uninterested leads. The result is a more efficient and cost-effective marketing operation that delivers measurable results and a higher return on investment.

Customer Retention And Loyalty Programs

While acquiring new customers is important, retaining existing ones is even more critical in the financial sector, where long-term relationships drive lifetime value. Marketing automation plays a key role in customer retention by enabling ongoing communication, education, and engagement. Financial institutions can use automation to send timely account updates, personalized financial tips, loyalty rewards, and satisfaction surveys. For example, an insurance company might automate policy renewal reminders and include value-added content like home maintenance tips or safety checklists. These small, consistent touchpoints help keep customers engaged and satisfied, reducing churn and encouraging referrals.

Use Cases Across Financial Sectors

Marketing automation is not limited to one segment of the financial industry—it has applications across banking, insurance, investment services, credit unions, and fintech startups. In retail banking, automation can be used for onboarding new customers, promoting new services, and cross-selling products. In the insurance sector, it can streamline claims communication, send policy reminders, and nurture leads for new policies. Investment firms can use automation for thought leadership content, performance updates, and client segmentation based on portfolio size. Fintech companies, with their tech-first approach, can use marketing automation to deliver hyper-personalized mobile experiences, onboarding tutorials, and automated customer service.

Selecting The Right Marketing Automation Platform

Choosing the right marketing automation tool is crucial for achieving desired results. Financial institutions must consider factors such as scalability, integration capabilities, compliance features, analytics, and user-friendliness. Some popular platforms that cater well to financial services include HubSpot, Marketo, Pardot (Salesforce), and ActiveCampaign. Each platform offers a different set of features, so decision-makers should assess their specific needs, budget, and internal resources before making a choice. Integration with CRM systems, data security protocols, and regulatory compliance support are particularly important for financial organizations to evaluate during the selection process.

Implementing Marketing Automation Successfully

Implementing a successful marketing automation strategy requires more than just adopting new technology—it demands a clear vision, alignment across departments, and a strong foundation of customer data. Financial firms must start with defined goals, such as increasing customer acquisition, boosting engagement, or improving lead quality. Next, they should segment their audience, map the customer journey, and create content tailored to each stage. Training staff, establishing KPIs, and testing workflows are also essential steps. Regular audits and adjustments will ensure the automation strategy evolves with changing customer needs and market dynamics.

The Future Of Financial Services Marketing Automation

As artificial intelligence and machine learning continue to evolve, the future of financial services marketing automation looks even more promising. Predictive analytics will enable marketers to anticipate customer needs before they arise. Chatbots and virtual assistants will become more sophisticated, handling complex queries and offering financial advice in real time. Hyper-personalization will reach new heights, with automation platforms dynamically adjusting messaging, offers, and content based on real-time behavior and contextual data. Financial firms that embrace these innovations will not only enhance customer experiences but also set themselves apart in a crowded and competitive marketplace.

Conclusion

Marketing automation is no longer a luxury—it’s a necessity for financial institutions aiming to thrive in a digital-first world. From increasing efficiency and personalization to ensuring compliance and driving ROI, automation empowers financial marketers to meet rising customer expectations while staying ahead of industry challenges. By embracing marketing automation, financial services can build stronger relationships, foster trust, and ultimately grow in a way that’s scalable, sustainable, and centered around the customer. As technology continues to advance, the institutions that invest in strategic automation today will be the ones leading the financial landscape tomorrow.